The Keys to Your Future Are Just a

Click AwayWe help you move from dreaming to doing—starting now.

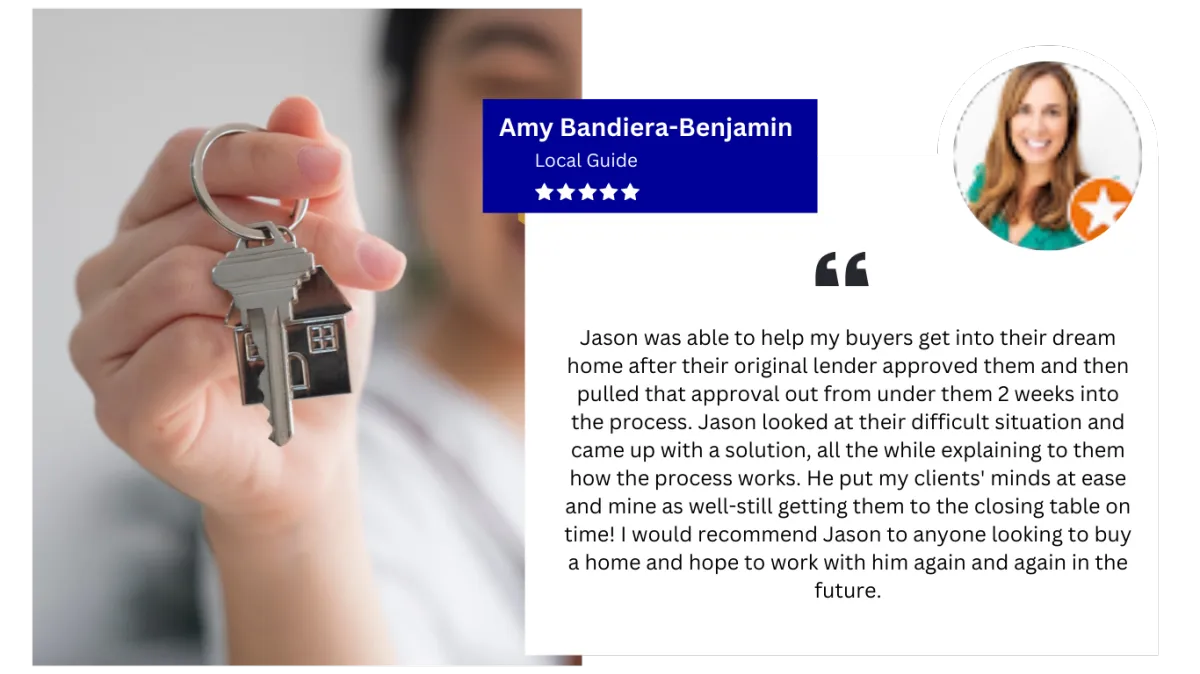

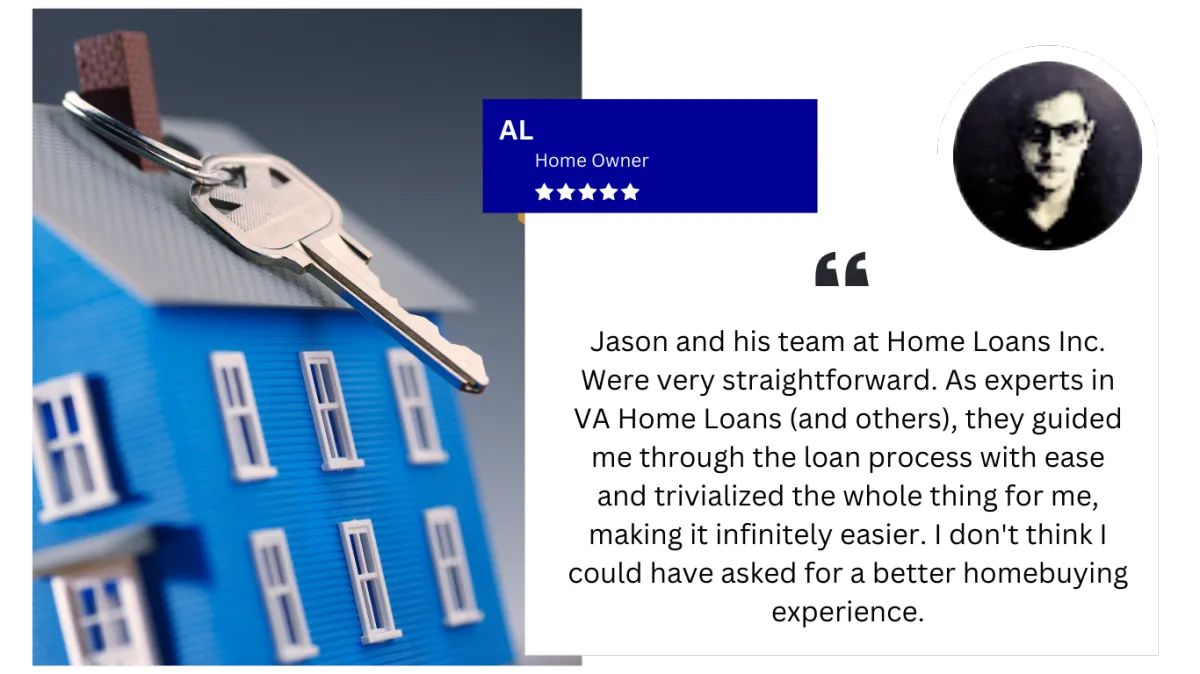

Join 0+ Happy Homeowners Who Found Their Perfect Loan

Rated 5.0

★ ★ ★ ★ ★

Know What You Can Afford in Seconds

Enter your details and see your estimated monthly payment instantly.

A Home Loan Built for You.

Your future starts with the right mortgage.

Renting is temporary. Homeownership is lasting

Imagine the confidence of walking into a home that is truly yours. No more asking permission to make changes, no unexpected rent increases—just security, stability, and a place to call your own. Homeownership isn’t just a milestone—it’s a future you can count on.

STILL NOT SURE?

Frequently Asked Questions (FAQs)

Your Guide to Understanding Home Loans and the Application Process

Question 1: What types of loans does Home Loans Inc. offer?

We offer a variety of mortgage loan options to fit your needs:

- Fixed-Rate Mortgage: A loan with a stable interest rate for predictable monthly payments.

- VA Home Loan: A loan program for veterans and active-duty service members with favorable terms.

- USDA Loan: A loan program for rural and suburban homebuyers with low-to-moderate income. Jumbo Home Loan: For higher-value properties exceeding conventional loan limits.

- Rehab Loan: For homebuyers looking to purchase and renovate a property.

- First-Time Home Buyer Loan: Tailored loans for those purchasing their first home.

- Low Down Payment Options: Loans with minimal down payment requirements for eligible buyers. Investment Property Loans: Loans for purchasing rental properties.

- Refinance: Options to refinance your existing mortgage for better terms.

Question 2: How do I know which loan option is right for me?

Our loan specialists are here to help you select the best option based on your financial situation and goals. Schedule a Goal Analysis Consultation to discuss your options.

Question 3: What is the pre-qualification process?

The pre-qualification process is simple and involves:

- A short consultation to understand your financial goals.

- A review of your income, credit, and asset details.

- A quick estimate of the loan amount you could qualify for.

Question 4: How long does the approval process take?

Once we have all necessary documentation, the approval process can take about 30-45 days, including underwriting and closing. However, we provide transparent, step-by-step communication throughout the process.

Question 5: What are closing costs and how much should I expect to pay?

Closing costs typically range from 2% to 5% of the loan amount. These costs include fees for the appraisal, title search, and loan processing. We will provide an estimate of closing costs early in the process, so you're prepared.

Question 6: Can I get a home loan with a low credit score?

Yes, we offer options for buyers with varying credit histories. FHA loans, for instance, may accept lower credit scores. We work with you to find the best solution for your unique situation.

Question 7: What is private mortgage insurance (PMI)?

PMI is often required for conventional loans with a down payment of less than 20%. It protects the lender in case of default. Once you reach 20% equity in your home, you may be eligible to cancel PMI.

Question 8: How do I lock in my mortgage rate?

Home Loans Inc. offers up to 120-day rate lock protection, ensuring your rate won’t change, even if market conditions fluctuate.

Question 9: What documents do I need to apply for a loan?

You will need to provide:

- Proof of income (W-2s, pay stubs, tax returns)

- Proof of assets (bank statements)

- A valid ID

- Credit history (we will pull this as part of the application)

Question 10: Is there a penalty for paying off my loan early?

No, we do not charge a prepayment penalty. You are free to pay off your mortgage early without incurring extra fees.

Schedule Your Initial Goal

Analysis Consultation Here

What are your goals?

We are committed to helping

you reach them.

Whether you're a first-time homebuyer or a seasoned investor, having the right mortgage team by your side makes all the difference.

COMPANY

NMLS: 1281448 | COMPANY NMLS: 1728740

CUSTOMER CARE

LEGAL

© Copyright 2025. Jason Sharon, Broker/Owner of Home Loans Inc. All Rights Reserved.